Introduction

Life insurance is a cornerstone of financial planning, offering peace of mind and protection for your loved ones. But with a myriad of options available, how do you determine the best life insurance policy for your unique needs? In this article, we’ll guide you through the process of selecting the best life insurance policy that aligns with your goals and provides the coverage you deserve.

Understanding the Importance of Choosing the Best Life Insurance

Choosing the best life insurance policy is crucial for ensuring your family’s financial security in your absence. It provides a safety net to cover financial obligations and support your loved ones.

Key Factors to Consider When Evaluating Life Insurance Policies

Consider the coverage amount and type that aligns with your family’s needs. Additionally, determine the duration of coverage based on your financial goals.

Different Types of Life Insurance Policies

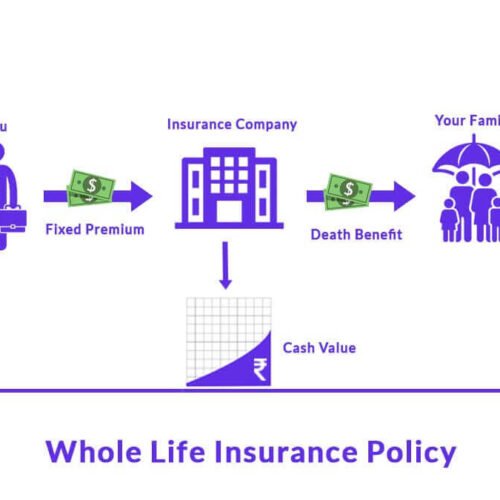

Explore the various types of life insurance policies available, including term life insurance for temporary coverage, whole life insurance for lifelong protection, and universal life insurance for flexibility.

Assessing Your Financial Needs and Goals

Evaluate your current and future financial needs, including outstanding debts, mortgage payments, and education expenses. Determine an appropriate coverage amount to secure your family’s well-being.

Comparing Premium Costs and Benefits

Balance the cost of premiums with the coverage and benefits offered by different policies. Consider additional options such as policy riders and add-ons that can enhance your policy’s value.

Evaluating the Credibility of Insurance Providers

Research the financial strength and stability of insurance providers. Look for companies with high credit ratings and positive customer reviews to ensure reliability.

Understanding Policy Terms and Conditions

Thoroughly review policy documents to understand exclusions, limitations, and premium payment terms. Clarify any uncertainties with the insurance provider before finalizing your decision.

Seeking Professional Advice

Consult with a financial advisor to receive personalized guidance on choosing the best life insurance policy. Gather quotes from multiple providers to compare options.

Making an Informed Decision

Narrow down your choices based on the factors that matter most to you, such as coverage amount, premium affordability, and additional benefits. Review your chosen policy and finalize your decision.

Conclusion

Selecting the best life insurance policy requires careful consideration of your family’s needs, financial goals, and personal preferences. By evaluating key factors, seeking professional advice, and comparing options, you can confidently make a choice that provides lasting financial security.

Frequently Asked Questions (FAQs) About Finding the Best Life Insurance

Q1: How much life insurance do I need?

A: The appropriate coverage amount varies based on your financial obligations, family size, and long-term goals.

Q2: Is term life insurance sufficient for my needs?

A: Term life insurance can be suitable for temporary needs, such as mortgage protection or income replacement during working years.

Q3: What are the benefits of whole life insurance?

A: Whole life insurance offers lifelong coverage, builds cash value, and provides a death benefit to beneficiaries.

Q4: Should I buy life insurance online or through an agent?

A: Both options have advantages. Buying online offers convenience, while an agent can provide personalized guidance.

Q5: Can I change my life insurance policy later?

A: Depending on the policy type, you may have options to adjust coverage or add riders, but changes may involve additional underwriting.