Introduction

Securing your family’s financial future is a priority, and life insurance plays a vital role in achieving that goal. But how do you find the right coverage that fits your needs and budget? That’s where life insurance quotes come in. In this comprehensive guide, we’ll explore the importance of life insurance quotes, how they work, the factors that influence them, and how to use them to make an informed decision.

Understanding the Significance of Life Insurance Quotes

Life insurance quotes provide you with a clear estimate of how much you might pay for coverage based on your unique circumstances. They empower you to make informed decisions about your financial protection.

The Role of Life Insurance Quotes

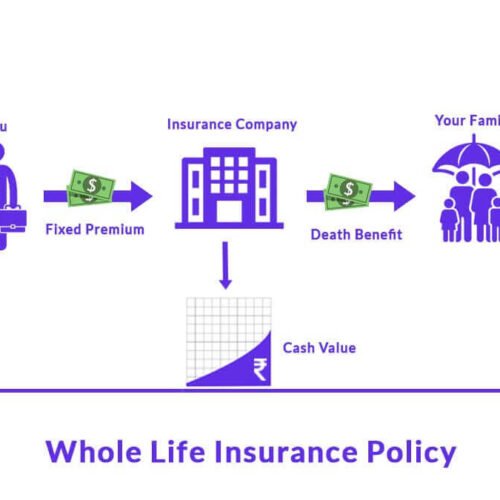

Life insurance quotes allow you to customize coverage amounts and assess premium costs, enabling you to design a policy that aligns with your budget and needs.

Factors Influencing Life Insurance Quotes

Your age, health condition, desired coverage amount, and policy type are all critical factors that influence the quotes you receive. Lifestyle choices like smoking or engaging in high-risk activities can also impact the quotes.

Where to Obtain Life Insurance Quotes

You can obtain life insurance quotes from insurance company websites by providing your information and coverage preferences. Independent quote aggregators allow you to compare quotes from multiple providers in one place.

Using Life Insurance Quotes Effectively

Compare quotes from various providers to get a comprehensive view of your options. Don’t hesitate to ask questions about coverage details, exclusions, and potential discounts.

Tips for Getting Accurate Life Insurance Quotes

To ensure accuracy, provide precise and up-to-date information when requesting quotes. Additionally, inquire about any potential additional fees that might affect the final cost.

Choosing the Right Life Insurance Policy Based on Quotes

When comparing quotes, consider the balance between premium costs and coverage benefits. Long-term affordability is crucial to ensure you can maintain your policy over time.

Applying for Life Insurance After Receiving Quotes

After receiving quotes, you can proceed with applying for a policy. This often involves undergoing medical examinations and providing the necessary documentation.

Maintaining Flexibility with Life Insurance Quotes

Life circumstances change, so revisit quotes periodically to ensure your coverage remains aligned with your needs. Stay open to new offers and policies that might better suit your evolving situation.

Conclusion

Life insurance quotes serve as valuable tools that help you navigate the complexities of finding the right coverage at an affordable price. By understanding how quotes work, leveraging their insights, and applying them to your decision-making process, you can secure the financial protection your loved ones deserve.

Frequently Asked Questions (FAQs) About Life Insurance Quotes

Q1: Are life insurance quotes accurate? A: Quotes are based on the information you provide and are generally accurate, but final rates may vary based on underwriting.

Q2: How often should I get new quotes? A: It’s a good idea to revisit quotes when your life circumstances change, such as marriage, having children, or major financial changes.

Q3: Can I negotiate premium rates? A: Premium rates are typically set by the insurance company, but you can explore different policy options to find affordable coverage.

Q4: Can I change my coverage after receiving quotes? A: Yes, you can adjust your coverage amount or type based on your needs, even after receiving quotes.

Q5: Is there an obligation to purchase after getting a quote? A: No, getting a quote does not obligate you to purchase a policy. It simply provides you with information to make an informed decision.